Montpelier, Indiana

Montpelier is a Great Place to Call Home

WHY MONTPELIER IS A GREAT PLACE TO CALL HOME

I grew up in Montpelier, and like many, I moved away for a few years as an adult. In 1995, my wife and I returned to start our family — and I quickly realized just how special this place truly is. After living in several cities, both midsize and large, I came to appreciate all that Montpelier offers with its unique small-town charm.

A Wonderful Place to Raise a Family

Montpelier is the kind of community where kids can still ride their bikes across town without fear. Our two children grew up here, and we loved knowing they were safe, surrounded by caring neighbors who looked out for one another.

A Walkable, Convenient Community

One of Montpelier’s greatest features is how walkable it is. You can stroll to local shops, the grocery store, the library, our Civic Center, or one of several nearby churches — all without needing to start your car. Many residents simply enjoy walking our tree-lined streets for exercise or relaxation.

No Traffic, No Stress

If you’ve ever been stuck in a traffic jam elsewhere, you’ll appreciate Montpelier’s ease of travel. Here, “rush hour” means a few cars at a stoplight — no road rage, no long commutes, and no wasted time.

Safe and Peaceful

Montpelier’s low crime rate adds to our sense of peace and security. Our police department works hard to maintain a safe, welcoming environment where residents can truly relax and enjoy life.

Affordable Living

Our low cost of living makes Montpelier an attractive place for families. When my wife and I decided she would stay home with our children, affordable housing prices made it possible for us to live comfortably on a single income.

A Golf Cart Community

Montpelier is a certified golf cart community — and that’s part of what makes us unique! Residents use golf carts to run errands, visit friends, or simply cruise through town on a summer evening. It’s a fun, friendly way to connect with neighbors and enjoy the outdoors.

A Close-Knit, Caring Town

This might be Montpelier’s greatest strength. When someone here faces a challenge, the community steps up — with meals, fundraisers, prayer vigils, or simply showing up to lend a hand. It’s not just a city; it’s a family.

Get Involved — Make a Difference

In Montpelier, it’s easy to get involved and make an impact. Whether it’s volunteering at community events, joining a local board, or supporting our parks and youth programs, every person can help shape our future.

Come see for yourself why Montpelier truly is “A Great Place to Call Home.”

~Mayor Brad Neff

Opportunity Zones

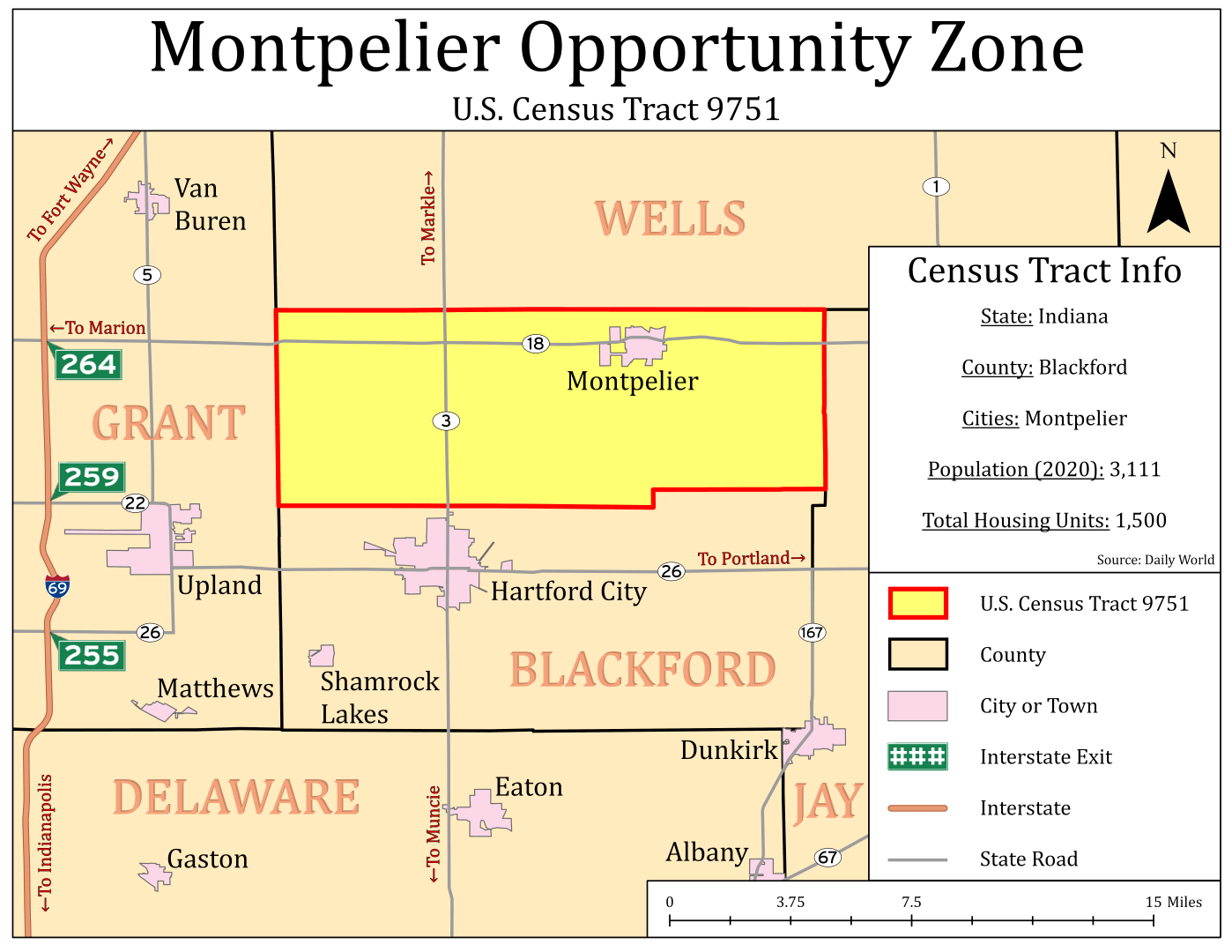

In 2017, the Tax Cuts and Jobs Act created Opportunity Zones. These are special land designations that qualify investments in these areas for capital gains tax incentives. The entirety of Montpelier rests within the Blackford County Opportunity Zone, which follows the borders of U.S. Census Tract 9751

(North of CR 200N to Wells County Line – East to Jay County Line – West to Grant County Line – see map).

A Qualified Opportunity Fund (QOF) is a project within the boundaries of an Opportunity Zone that has received special tax status from the Internal Revenue Service (IRS). There are many tax incentives associated with investing in QOFs, which will be reviewed below. Investors can find and invest in an already approved QOF, or they can apply to create a new QOF with the IRS.

How an Opportunity Zone Works:

- Sell an asset

- Within 180 days of the sale of the asset, reinvest capital gains in a QOF

- After 5 years in a QOF, 10% of the reinvested capital gains are excluded from federal capital gains tax

- After 10 years in a QOF, any appreciation on the value of the reinvested capital gains is exempt from federal capital gains tax.

Example:

- Jim sells an asset for $1 million and reinvests the money into a QOF within 180 days

- After 5 years, Jim only has to pay federal taxes on $900,000 of the capital gains of that initial $1 million sale

- After 10 years, his $1 million investment appreciates to $2 million. Jim only has to pay federal taxes on the first $1 million.